Economy

General Background:

The perspective of the Kazakhstan economy is closely connected with further integration into international economic relations, utilisation of unique reserves of energy and mineral resources, vast possibilities to export industrial and agricultural products, optimum employment of country's transit potential and also with availability of highly qualified specialists in different spheres.

During the Soviet period Kazakhstan was an agrarian, raw materials supplier of the former Soviet economy, where the military industry played the major role. The main economic content of 15 years of independence has become transition from the central command planning to a market system. During these years, Kazakhstan has made considerable progress in implementing complex political, economic and social reforms to establish a democratic state with a market economy.

While the country has not experienced political disturbances during the transition period, it has faced numerous economic, social and environmental challenges.

The first few years of Kazakhstan’s independence were characterized by an economic decline (mostly due to the destabilizing force of disintegration of the Soviet Union): by 1995 real GDP dropped to 61,4% of its 1990 level. This economic deterioration exceeded the losses experienced during the Great Depression of the 1930s.

The wide-ranging inflation observed in the early 1990s peaked at annual rate of up to 3000% in mid-nineties.

Since 1992, Kazakhstan has actively pursued a program of economic reform designed to establish a free market economy through privatization of state enterprises and deregulation and today is generally considered to be more advanced in this respect than most other countries of the CIS.

Kazakhstan remains one of the most successful reformers in the CIS, and it has the strongest banking system in Central Asia and CIS.

The main goals of current structural policy are diversification and the strengthening of the non-oil sector. A number of development agencies and research centers (Development Institutions) have been established and the Government is looking at establishing techno and science parks to support the diversification of higher-value added industries. But there are certain obstacles inherited from the past to quickly achieve this.

The EU and USA have recognized Kazakhstan (first in CIS) as a country with market economy in 2001 and 2002 respectively. Kazakhstan has become the first country in the CIS to reach investment grade status. In January 2005 the Organization for Economic Cooperation and Development (OECD) has upgraded Kazakhstan’s country export risks rating, moving it from the 5th to the 4th group of risks.

Kazakhstan possessing sizable amounts of oil and gas, coal, uranium is an important energy player in the world. However, having these abundant resources, the Government and the country’s energy sector keep an attentive eye on global energy trends. Optimal energy mix, energy use efficient, significant environment component of energy policy, research and development of renewables are all on the country’s energy policy agenda. In 2006 Kazakhstan has produced its first wheat-based bioethanol and this private sector programme will expand further.

Energy transportation and infrastructure are key elements of a viable energy policy. EU and its Energy Commissioner have identified last year their strong interest to cooperate with Kazakhstan in this area, particularly on trans-continental gas and oil transportation issues. Kazakhstan has made it clear that this fully meets its own vision for the development of multiple energy transportation routes from and through Kazakhstan.

Commercial viability, technical and environmental safety and financial soundness are the guiding principles for Kazakhstan’s strategy in this crucial area.

The main economic priority for Kazakhstan is to avoid overdependence on its oil and gas and minerals sector, but to use these natural assets to build a modern, diversified, highly-technological, flexible and competitive economy with a high value-added component. This is the central goal of the National Strategy until 2030 adopted in 1998 and the State Industrialization and Innovation Programme until 2015 launched in 2003.

In 2006 Kazakhstan has additionally announced a major drive for the Strategy to enter the 50 most completive nations in the world in ten years time.

In 2007 a State Program of “30 Corporate Leaders of Kazakhstan” aimed at diversification of the economy has been launched. The goal of the Program is to modernize the economy and support Kazakh companies willing to enter international markets through offering competitive products.

Diversification of the economy, introduction of international technical, financial, business standards, accession to the WTO, promotion of corporate governance, greater transparency and accountability, education and a concerted administrative reform have been identified as the key drivers to implement the above strategies.

In 2006 the Government has drastically increased the budget of a state-run scholarship programme “Bolashak” (“Future”). If to date only about 800 Kazakh students could enjoy the benefits of “Bolashak” scholarship since its inception in 1994, starting from 2006 the Government fully funds 3000 Kazakh students annually to study in the world’s best universities. As of February 2008 intake of “Bolashak” students in the US reached 778 young Kazakhstanis.

Aiming to cut bureaucracy the Government is widely introducing the “e-government” in all major sectors. This measure coupled with other result-oriented administrative reform steps is viewed, among other things, as an important tool in the fight against red-tape and corruption.

In order to further improve the country’s competitive edge and regional role through enforcing the principles of efficient corporate governance and management, greater transparency and accountability as well by boosting its financial markets the Government has taken major steps in early 2006, namely it established the “ Samruk” State holding company, “Kazyna” Fund for sustainable development and initiated the establishment of the Regional Financial Centre in Almaty (RFCA).

Over the last three years (2005-2008) 21 Kazakhstan companies have been listed at the London Stock Exchange (10 on the main market, and 11 on AIM, market for growth companies). This has proved de-facto Kazakhstan’s leadership in the former Soviet Union in implementing Western instruments, managerial skills and business standards in the country’s economy.

Starting from 2005 Kazakhstan has been practically implementing the UK’s Extractive Industries Transparency Initiative with the aim to deliver a clear signal to international investors community and financial institutions that the Government of Kazakhstan commits itself to greater transparency to further improve investment climate, strengthen accountability and good governance, as well as promote greater economic and political stability throughout the country which will be based on the principles of decentralization, industry specialization, free market competition and transparency.

Kazakhstan has officially announced its aspiration to become a trilingual nation to help meeting its ambitious goals. These will be Kazakh as the state language, Russian as the language of interethnic communication, and English as the language of successful integration into the global economy and community.

Social and political stability, along with tremendous natural resources, make Kazakhstan one of the most attractive destinations for capital investments among the republics of the former Soviet Union.

[+] Energy Sector

Hydrocarbons

The proven large reserves of oil and gas (about 3% and 1% respectively of the world’s total) and significant forecast reserves (13-18 billion tonnes of standard fuel) in Kazakhstan, make investing in the fuel and energy sector a priority.

At the moment, hydrocarbons are being developed at 241 fields, consisting of extraction at 74 fields (31%), extraction and prospecting at 106 (44%), prospecting at 59 (24%) and operations unrelated to extraction at two (1%). A total of 142 companies are operating in the sector: 20 joint ventures, 48 foreign companies and 74 local companies.

In total, $40.6 billion in investment have been attracted to the sector. Most of the investment was in extracting hydrocarbons; as a result, output doubled and exceeded 60 million tonnes of oil and gas condensate and 27 billion cubic metres of gas. And the limit has not yet been reached: according to forecasts, the country will extract up to 100 million tonnes of oil by 2010 and about 150 million tonnes of oil by 2015.

It should be noted that Kazakhstan occupies the eighth place in terms of proven oil reserves in the world and second place in the CIS. The proven reserves will ensure extraction for 50 years for oil and 75 years for gas which is in line with the world average figure for oil-extracting countries. The future development of the domestic oil sector mainly depends on developing the Kazakh sector of the Caspian Sea, whose forecast reserves are quite promising.

Oil And Caspian Off-Shore Development Strategy And Pipelines Policy:

After Russia, Kazakhstan was the second largest oil-producing republic in the former Soviet Union at the time of its collapse, with production of about half a million barrels per day (bbl/d) in 1991. Kazakhstan has significant petroleum reserves. Proven oil reserves as of today are 32,5 bln. barrels. Projected oil reserves are 100-110 bln. barrels by 2015, placing Kazakhstan in global top five. Some estimates say that the offshore Kashagan field alone may contain up to 50 billion barrels of oil. Kazakhstan’s vast natural resources are projected to provide 2-3% of the worlds expected oil demand within the next decade.

State-run Program of Development of the Kazakhstan’s Sector of the Caspian Sea (KSCS) (herein after referred to as the Program) was elaborated with due consideration of the Government Program for 2002-2004, Strategy of Energy Resources Exploitation, and Strategic Plan of Development of the Republic of Kazakhstan up to 2010.

The ultimate goals of the Program have been defined as contribution to sustainable economic growth and upgrade of life quality of the Kazakhstan’s citizens through rational and safe development of the Caspian hydrocarbons; and encouragement of related sectors’ development.

By 2002, most O&G fields under development had reached peak levels of annual production. Further growth of ashore production output was first of all linked to intensified development of such oilfields as Tengiz and Karachaganak. At the same time, research has shown that major gains in explored reserves and in hydrocarbons production are expected to take place in the Caspian aquatic area. According to world practice, starting from the point of exploration works in offshore, it normally takes 8-10 years to get to the commercial production stage. The Program provides forecast for up to 2015. The Program takes into account growing importance of off-shore O&G, and integrates principles of rational subsoil use and environmental safety requirements. The Program envisages turning of the KSCS into a major hydrocarbons production zone in Kazakhstan.

Apart from development of O&G in the KSCS, the Program provides for development of associated production, social and environment-protection facilities.

For the recent 30 years there have been certain trends formed that have the global GDP growing 3,3% per annum, with the demand for oil as the major energy source growing by 1% per annum.

Hydrocarbons consumption lagging behind from GDP growth is attributed to resource-saving programs implemented primarily in industrialized nations. At the same time, the share of developing countries in the global GDP and in hydrocarbons consumption has been steadily increasing. This adds to the problem of hydrocarbons supply sufficiency.

According to international experts, with the current trends maintained, the global explored oil resources will only suffice for the next 40-50 years. Inclusion of the KSCS (Kazakhstan’s Sector of the Caspian Sea) resources into the global explored reserves has become a major component of global energy strategies. Kazakhstan is to be ready for flexible mix of strategies of systematic relocation of oil production to the Caspian aquatic area with speed-up of selected promising projects.

Proximity to such dynamically developing nations as Russia and China opens wide opportunities for Kazakhstan’s hydrocarbons exports. To ensure entering into the markets of the two countries, it is vital to develop and enhance trunk pipelines system.

Legal status of the Caspian Sea

Emergence of independent states in the post-soviet territories entailed search for solutions to multiple problems arising upon gaining sovereignty by the once Soviet republics. One of the problems was territorial issues. Caspian littoral states faced the necessity to ensure fair and civilized delimitation of the Caspian Sea. If up to 1991 the Sea had belonged to only 2 states, now its waters wash the coastlines of 5 sovereign states – Russia, Iran, Azerbaijan, Kazakhstan and Turkmenistan.

As of today, the Kazakhstan’s Sector of the Caspian Sea is regulated by the following agreements:

July 6, 1998 Kazakhstan and Russia signed agreement on delimitation of the Caspian Seabed, with a Protocol to the Agreement being signed in Moscow May 13, 2002.

November 29, 2001 Kazakhstan and Azerbaijan signed agreement on delimitation of the Caspian Seabed, with a Protocol to the Agreement being signed in Baku February 27, 2003.

May 14, 2003 Kazakhstan, Azerbaijan and Russia signed agreement on the junction point of lines delimiting adjacent zones of the seabed and subsoil of the Caspian Sea, which finalized the process of legal registration of the national sea bottom sectors of the three states.

Speed-up of elaboration and adoption by all of the littoral states of the Frame Convention on the Legal Status of the Caspian Sea incorporating issues of the seabed delimitation is an important political move in putting in place legal ground for the Kazakhstan’s sector exploration.

Investments

Up to recently, investments into development of the Caspian hydrocarbons potential were channelled within the frameworks of two projects – Northern Caspian Project and KazakhOil –JNOC Project. Northern Caspian Project is a logical continuation of the works started in 1993 by the International Consortium; it has been implemented on the basis of the PSA signed [on sea blocks] by Kazakhstan. As of January 1, 2008, investments within the Northern Kazakhstan Project reached USD 15,7 billion.

Works on the KazakhOil – JNOC Project started in March 1999. Expenses totaled USD 50 million. According to the basic agreement signed by KazakhOil and JNOC there was geological exploration performed, including areas Terenozek – Prorva and Northern Slope of the Bozashin Arch located in hard-to-reach zones of the intermediate part of the Caspian Sea.

KSCS development calls for solutions to problems reflecting inter-industry nature of tasks of long-run extension of maritime O&G operations, dependence of many development parameters on the composition of hydrocarbons and on geologic and technical conditions at the oilfields.

Main targets in KSCS development:

gains in explored hydrocarbons resources and bringing of production to a stable high level;

development of multimodal system of hydrocarbons transportation;

- reprofiling and modernization of domestic machine-building enterprises;

- development of the maritime fleet and sea ports;

- build-up of the local engineering capabilities; training of domestic specialists;

- enforcement of health protection and environment protection measures;

- development of petrochemistry enterprises.

The order of the KSCS resources development will be based on uniform allocation of blocks to subsoil users in northern, central and southern parts of the sea. Blocks adjacent to protected natures sites, recreation zones, defence sector facilities and large population clusters can bean exception.

The Government shall be in charge of defining blocks to be offered for tenders, and of defining the order and conditions of setting them forth for tenders.

The order of setting of blocks forth for tenders is a package of procedures targeted to ensure staged and rational development of production potential; the package includes defining of blocks’ territory, arrangement of tenders and negotiations with prospect investors.

At the present time, there are about 23 undistributed blocks, exploration of some of them is planned to be financed out of the state budget. To define the most suitable subsoil users for both exploration and development, the plan is to offer for tenders at least 3 blocks per annum. At the same time, there will be blocks offered for additional exploration. Thus, the initial stage will cover 7-8 years (up to 2010), in the course of which necessary amendments could be inserted in the schedule of development up to 2015 with a view of transportation and marketing issues.

On-land production has been performing by 33 companies at over 100 oilfields located in 5 oblasts. Major gains in production take place at Tengiz, Karachaganak, Uzen and some other oilfields.

The Kazakh Government’s commitment in cooperation with partners from abroad is to respect contracts signed with foreign companies but the contracts must be honoured by both sides.

Research showed that substantial gain in hydrocarbons production is expected to take place in the KSCS. Recoverable reserves of the KSCS stand at 8 billion tons. At the first stage – up to 2005– major works included drilling of exploratory wells in blocks of first priority.

Forecast KSCS resources allow bringing production at the KSCS oilfields to 100 million tons per annum and maintaining the said level for 25-30 years.

In January 2008 Kazakhstan successfully finished talks with Kashagan consortium (“Eni”, JSC “National Company KazMunayGas”, “ExxonMobil”, “Shell”, “ConocoPhillips” and “Inpex”). The companies signed the Memorandum of Understanding. The stake of “KazMunayGas” in the project was doubled to 16,8%, equalling the holdings of the largest western members of the consortium. “KazMunayGas” will take a bigger role in running the project. Kashagan is the largest single oilfield discovered anywhere in the world in the past 30 years. Annual production at Kashagan will make up 60 million tons in 2015. Production at other blocks of first priority is expected to start in 2009-2010.

According to preliminary estimates, the Program implementation will allow bringing production at maritime oilfields to 40 million tons in 2010, and 100 million tons by 2015.

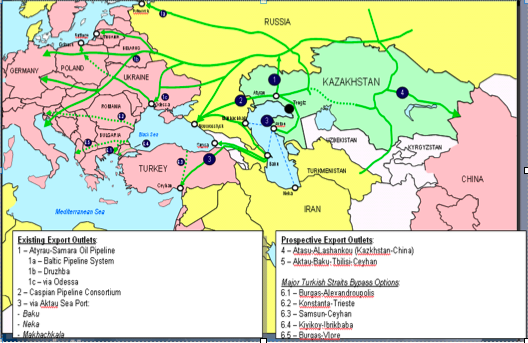

Export routes

Source: Platts

As KSCS oilfields get developed, the need for diversification of export routes keeps growing. Enhancement of export routes implies multimode transportation of hydrocarbons, with efficient combination of capabilities of pipe, railway and sea transport.

Below is the list of current and prospect routes for transportation of hydrocarbons from the KSCS oilfields:

Main oil pipe Uzen – Atyrau – Samara. One of transit export routes for Kazakhstan’s oil via Russia. Given planned growth of oil production in Western Kazakhstan, there is a plan of staged build-up of the pipe’s carrying capacity.

Baltic Pipelines System is a promising route to increase Kazakhstan’s oil supply to the market of East Europe and Baltic States.

Caspian Pipeline Consortium (CPC). Given the attractiveness of the Mediterranean market for high-quality grades of Kazakhstan’s oil, CPC is a major export route. In this connection, carrying capacity of the pipe is planned to be expanded to 67 million tons by 2011.

Sea port of Aktau. Oil transfer capacities of the port and/or those of the Aktau port branches in the bays of Bautino and Kuryk is planned to be increased to 8 million tons per year.

The current transport systems will be sufficient for export of domestically produced oil up to 2009.

When after 2009 oil production in Kazakhstan hits the target of 92 million tons per year, including 21 million tons at KSCS, there will be a need for construction of the first new export pipeline. When production hits the mark of 140 million tons per year, including 54 million tons at the KSCS, there will be a need for construction of a second new export pipeline by 2012.

In this context, the following oil transportation routes are being considered:

Aktau – Baku (Baku – Tbilisi Ceyhan (BTC) pipe).

Project Western Kazakhstan – China. Access to the Chinese market and to Asia Pacific market for the Kazakhstan’s as a promising export route. There’s a master agreement between the Kazakhstan Ministry of Energy and Mineral Resources and the CNPC to construct a pipeline running from Western Kazakhstan to Western China.

Project Kazakhstan – Turkmenistan – Iran. According to preliminary research, this route is economically viable to export Kazakhstan’s oil to the Gulf countries. The project stipulates that the oil pipe starts in Western Kazakhstan and runs via Western Turkmenistan to northern Iran.

Kazakhstan’s policy is to make a positive contribution to global energy security. This largely aims Kazakhstan’s energy resources export strategy on diversification of the transportation systems.

Financial Strategy

In 2006-2010, investments into the KSCS development are expected to reach USD 12,9 billion, and another USD 16,8 billion in 2011-2015.

The core of the financial component of the Program is full assumption of exploration-related risks by subsoil users and investors up to the approval of the first plan of development.

To ensure gains in O&G production, it is possible to attract additional financial resources from Kazakhstan’s sources through issues of debt by subsoil users. The securities can be then purchased by domestic accumulation pension funds, second-tier banks, and other financial institutions, as well as individuals.

Maximum possible attraction of internal investment capabilities for the Program implementation should be a priority component of the financial strategy.

The Program implementation allows bringing oil production in the KSCS to 100 million tons in 2015. Assumed gas production will make up 63 billion cubic meters in 2015.

Performance of oil operations in the KSCS calls for vast investments: the need for investments in 2006-2010 will reach KZT 1545 billion ($10,3 billion).

Inflow of major part of oil revenues is expected upon completion of the first and second stage of development. At the third stage, the state budget is expected to enjoy substantial revenues coming from maritime operations.

Coal

The coal sector is also a priority investment area. Kazakhstan is among the world’s top 10 coal-rich countries, after the USA, Russia, China, Australia, India, South Africa and Ukraine. Kazakhstan contains Central Asia’s largest recoverable coal reserves. The state register records 142 closed mines and 55 open-pit mines. Most mines are located in central Kazakhstan (the Karaganda and Ekibastuz coal basins and the Shubarkol mine) and north Kazakhstan (the Torgay coal basin). Recoverable reserves account for 45% and unrecoverable 55%.

Mining is carried out at 53 mines, including 15 in the Karaganda coal basin, by 34 companies (one joint venture, five foreign and 28 local companies). The major companies are: Bogatyr Access Komir, Shubarkol Komir, Mittal Steel Temirtau, the Eurasian Energy Corporation, Maykuben West, Karazhira Ltd, the Kazakhmys Corporation and Gamma. These companies invested over $3bn in mining coal (however, only 1% of it was spent on prospecting). The annual volume of investment grew 10-fold in 2005 from 1996 volumes and totalled $375m; output reached about 80 million tons. This figure is expected to grow to 90 million tons by 2010 and 95 million tons by 2015.

The coal sector is said to have enough reserves to last over 100 years. In future, the development of the raw materials base will be achieved through enriching and improving the quality of the coal and the deep processing of coal to obtain fluid fuel and synthetic substances. Developing shale is also topical. As an alternative source of energy, methane from coal mines in the Karaganda basin can be used. The high concentration of methane in coal layers and the existence of a well-developed infrastructure and major gas consumers make it possible to extract it and utilise it on a large scale. This will also increase central Kazakhstan’s energy potential and provide gas not only to enterprises in Karaganda, Ekibastuz and Pavlodar districts but also to the country’s capital, Astana.

Uranium

Kazakhstan has the second largest uranium reserves in the world (following Australia), at around 1.5 million tons, which represents almost 20 percent of the world's supply. Kazakhstan aims to overtake Australia and Canada as uranium exporters by 2010. In 2006, Kazakstan produced approximately 5,280 tons of uranium, and the country has plans to increase production to 15,000 tons by 2010.

Kazakhstan has 55 uranium deposits, 70% of which are feasible for development using the underground leaching method. Kazatomprom, the Inkay and Katko joint ventures and the Stepnogorsk Mining and Chemical Combine are involved in uranium extraction. They are now extracting over 4,000 tons of uranium, 85% of which is extracted by Kazatomprom.

Over $551 million was invested in the sector in a decade, and 98% of this in extraction. The uranium sector has enough raw material base to last it 100 years.

Taking into account the growing capacities of nuclear power engineering and shortages of uranium, joint investment projects in Kazakhstan have already generated great interest among companies from the USA, Europe, Russia, Japan and China. In April 2005 South Korea and Kazakhstan established a joint mining venture for uranium, scheduled to begin operations in 2008 with an eventual annual output of 1,000 tons. In April 2006 Kazakhstan and Japan signed a civil nuclear cooperation agreement under which Japan will import uranium for power generation from Kazakhstan. Other foreign companies investing in Kazakhstan's uranium industry include Canada's SXR Uranium One Inc., Japan's Marubeni Corp., China's Guangdong Nuclear Power Group, Britain's New Power Systems Ltd. and the U.S. uranium trading company Nukem. In October 2007 Kazatomprom completed its purchase of a 10% stake in the US based Westinghouse Electric Co. LLC from Toshiba for $540 million.

Industrial Development and New Development Institutions

From the very outset the Government of independent Kazakhstan have sought to lay the foundations of a market economy, civil society and democracy – simultaneously through pursuing economic growth and rising living standards whilst maintaining stability. It clearly understood that without all three there was little realistic expectation that newly won freedom could be preserved.

Of course, it had to rely on rich energy resources and spared no effort to ensure speedy development of this sector of the economy. But there was an early understanding that the oil could become a curse unless proper policies are developed, that oil is an opportunity, not a guarantee of economic success.

At the beginning of 2003 the Government of Kazakhstan has adopted The Innovative Industrial Development Strategy for the years 2003-2015 (New Industrial Development Strategy). The Strategy came at the time when basic economic reforms have been completed successfully replacing the old system of economic relations with market economy. In the first decade of its independence Kazakhstan was successful in fostering market-based institutions, the country’s energy industry saw a rapid growth and the banking sector has taken the leading positions within the CIS countries. In the last seven years Kazakhstan’s GDP grew by more than 75% and it is the leader within the CIS on inbound foreign direct investments per capita. From 1993 to January-September of 2007 Kazakhstan has attracted about USD 61,9 bln. of FDIs. It has been recognised by the leading industrial nations (US and EU) as a country with market economy.

At the beginning of 2003 the Government of Kazakhstan has adopted The Innovative Industrial Development Strategy for the years 2003-2015 (New Industrial Development Strategy). The Strategy came at the time when basic economic reforms have been completed successfully replacing the old system of economic relations with market economy. In the first decade of its independence Kazakhstan was successful in fostering market-based institutions, the country’s energy industry saw a rapid growth and the banking sector has taken the leading positions within the CIS countries. In the last seven years Kazakhstan’s GDP grew by more than 75% and it is the leader within the CIS on inbound foreign direct investments per capita. From 1993 to January-September of 2007 Kazakhstan has attracted about USD 61,9 bln. of FDIs. It has been recognised by the leading industrial nations (US and EU) as a country with market economy.

However, being aware of the economy’s heavy reliance on the energy and minerals sectors the Kazakh Government adopted an ambitious three-stage New Industrial Development Strategy to ensure sustainable development of the domestic economy through its genuine diversification, creation of new competitive industries, modernisation and expansion of the existing infrastructure with the ultimate goal of moving from an extraction-based industry to a service and technology based economy.

On top of the successfully operating National Oil Fund (see next section on p. --) and Development Bank of Kazakhstan (first ever institution of the sort in the FSU) established back in 2000 and 2001 respectively new development institutions have been established in 2003 within the Strategy, all deriving millions of dollars from oil revenues (this is apart from US$ 1.5 bln. set aside by the Government in the state budget from oil revenues for 2003-2005 to implement two more programmes – for further agricultural reform and for rural development). These new institutions are - the Investment Fund, Innovation Fund, Export Credit Corporation, Entrepreneurship Development Fund “Damu”, The Regional Financial Centre of Almaty, National Science and Technology Holding Company “Samghau”, “Kazyna Capital Management”, Corporation for Export Development and Promotion.

In general, the development institutions should form a unified system, the sustainable functioning of which will be based on the principles of decentralization, specialisation, competition and transparency.

Back to Top

[+] WTO Accession

1. Status of multilateral and bilateral negotiations

Kazakhstan submitted its official application for WTO membership in 1996. The Working Party on Kazakhstan’s accession to the WTO consists of 39 WTO member-states with 27 European Union member states as one party.

Negotiations are taking place around four key issues:

- Multilateral negotiations on systemic issues, where Working Party members review the existing regulatory framework for Kazakhstan’s economic and trade policies, and make recommendations on how to bring them into conformity with WTO agreements.

- Multilateral negotiations on agriculture, where Working Party members review the types and volumes of state support to the agricultural sector, and negotiate on the specific amount of the so-called “amber box” measures, which are considered as “trade distorting” and impacting on the price of agricultural products.

The US, EU, Australian, Swiss and Canadian delegations are active participants in the above two forms of negotiations.

- Bilateral negotiations on market access for goods, as a result of which Kazakhstan will bind its import duty rates for both agricultural and non-agricultural goods imported from WTO member-states.

- Bilateral negotiations on market access for services, as a result of which Kazakhstan will undertake specific commitments in terms of market access for foreign suppliers of services, such as financial, construction, telecommunication, legal and other types of services.

Kazakhstan has signed protocols concluding bilateral negotiations with 20 WTO member-states including Oman, Pakistan, Turkey, China, Georgia, Kyrgyzstan, South Korea, Cuba, Mexico, Japan, Norway, Honduras, the Dominican Republic, Bulgaria, Switzerland, Egypt, Israel, Brasilia, Malaysia and Canada .

Progress made in addressing systemic issues

Within the framework of multilateral negotiations on systemic issues, the following steps were undertaken.

a. In accordance with the new Law of the Republic of Kazakhstan “On Currency Regulation and Currency Control” of 13 June 2005, the currency regime has been significantly liberalized. Most notably, as of 1 January 2007, the licensing requirement for capital account transactions has been removed. It should be noted, however, that Kazakhstan has never applied any limitations with regard to capital inflow to the national economy.

As an alternative mechanism replacing the licensing requirement, as of 1 January 2007, Kazakhstan is applying registration and notification requirements for currency transactions with the sole purpose of maintaining accurate balance of payment, foreign investment, and foreign debt statistics. Hence, the registration and notification requirements will not be of a “permission requirement” nature.

As for further liberalization of currency market Kazakhstan plans to remove licensing requirement for retail trade and rendering of services for cash transactions in foreign currency.

b. In accordance with the WTO Agreement on Technical Barriers to Trade (TBT), the Technical Regulations Law of November 2005 introduced the mandatory nature of technical regulations and voluntary nature of standards, providing the legislative basis for developing an international system of technical regulations and standards. According to the Law, both technical regulations and standards are applied equally, regardless of the origin of a product or service. In December 2006 the Law adding amendments to the existing 33 laws on technical regulations in various sectors (fire safety, construction safety, and others) was signed by President Nazarbayev.

In 2007, within the framework of further implementation of laws on technical regulations, laws on Food Safety, on the Safety of Machinery and Other Equipment, On the Safety of Chemical Products, and On Toy Safety were passed. The main purpose of implementing the laws is to provide production safety, people’s health and environmental protection safety as well as the establishment of technical requirements of safety.

c. In accordance with the WTO Agreement on Sanitary and Phytosanitary Measures (SPS), amendments were made to national legislation on veterinary, plant quarantine and sanitary-epidemiological measures. For example, Kazakhstan ensured that its veterinary measures were based on an assessment of risks to human and animal life or health, taking into account available scientific evidence. Where relevant scientific evidence was insufficient, Kazakhstan could provisionally adopt sanitary or phytosanitary measures on the basis of the available information, including from relevant international organizations.

d. It should be noted that Kazakhstan has brought its national legislation into compliance with the WTO Agreement on Trade-Related Intellectual Property Rights (TRIPS). In particular: Amendments have been made to the Criminal and Administrative Codes of the Republic of Kazakhstan to increase responsibility for violation of the intellectual property rights through stricter penalty sanctions.

In April 2004, Kazakhstan acceded to the World Intellectual Property Organization’s (WIPO) Copyright Treaty and the Performances and Phonograms Treaty (so-called “internet treaties”). Amendments were made to several national laws in June2004 to ensure retroactive protection of intellectual property rights (IPRs) in accordance with the Berne Convention for the Protection of Literary and Artistic Works. To prevent the import of counterfeit products to and from Kazakhstan and to enforce domestic trade regulation measures, the Government of Kazakhstan has adopted Rules on Trade of Audio, Audiovisual and Software Products and Data Bases.

In November 2005, amendments were made to 11 laws regulating intellectual property rights protection. In accordance with Article 61 of the TRIPS agreement, the amendments introduced into Kazakhstan’s Criminal and Administrative Procedural Codes are called to increase responsibility for violation of intellectual property rights through strengthening the penalty sanctions. The Criminal Procedural Code was amended to ensure the ability to launch criminal proceedings for infringement of intellectual property rights without a formal complaint. Unlawful purchase, storage and transportation has been criminalized. In order to protect proprietarily information, Kazakhstan has amended the relevant regulations for registering pharmaceuticals and agrochemical products. It should be noted that we fully recognize that having the proper legislation and IPR policy in place is only a first step and the challenge for Kazakhstan as for many other WTO member-states, is on the enforcement side. I want to assure you that the Government is making every effort to strengthen enforcement, and to raise public awareness of IPR issues.

e. In accordance with the General Agreement on Tariffs and Trade (GATT) provision of the WTO to gradually eliminate quantitative restrictions and other measures:

A quota on imported ethyl spirit and alcoholic beverages products was eliminated in June 2004; Export bans on aluminum and nickel waste and scrap was abolished in December 2004;

and As of March 2006, export prohibitions on mazut and diesel during the agriculture season in support of local farmers was discontinued.

f. In accordance with WTO Agreements on Rules of Origin and Customs Valuation, in June 2005, the Government introduced changes to the Customs Code ensuring that the country of origin may only designate a country, group of countries or a custom unions (not parts of a country).

To address concerns raised by some WP members in January 2007, the Customs Code of Kazakhstan was amended and signed by President Nazarbayev. This law will: Eliminate use of the double MFN rate of Duty applied to goods of unknown origin; Introduce an amendment to Article 42 of the Customs Code to ensure full compliance with Article 2 (h) and Annex II, paragraph 3 (d) of the WTO Agreement on Rules of Origin. This Amendment will also clearly stipulate that the preliminary decision will be applicable to both preferential and non-preferential trade; Introduce Interpretative Notes to the WTO Customs Valuation Agreement as integral part of the Article 307 of Kazakhstan’s Customs Code.

g. In order to comply with WTO Agreements on safeguards, anti-dumping, subsidies, and countervailing measures, the necessary amendments to national legislation on trade remedy measures have been introduced. In particular, the definitions of “subsidy” and “domestic industry” have been modified, and the meaning of normal value in conducting anti-dumping investigations has been introduced. Investigation procedures have been brought into conformity with WTO norms to ensure transparency and mechanisms for consultations with the concerned parties.

h. Changes have been made to the Tax Code to align government policy to develop priority sectors of the economy with WTO norms. In addition, current excise tax regime for alcoholic beverages and tobacco products will be unified to conform to WTO non-discrimination and national regime principles.

The laws establishing special economic zones in Kazakhstan are being scrutinized by WTO member-states for compliance with WTO norms regarding subsidies to non-agricultural industries. It should be stressed that preferences in these zones will be available to both domestic and foreign investors.

i. Lastly, in accordance with a key WTO principle - transparency in developing and implementing economic and trade policies, Kazakhstan has adopted a new methodology for calculating fees for services applied to customs escort, import licensing and registration of legal entities. The new methodology will ensure that these fees reflect the real cost of services rendered.

Liberalization of key service sectors

The gradual liberalization of key sectors of the economy is proceeding together with Kazakhstan’s bilateral negotiations on access to the services market. For example: Amendments made to Kazakhstan’s legislation of licensing and consolidated supervision of financial services envisage eliminating existing requirements that:

the total paid-up capital of banks with foreign participation not exceed 50 percent of the aggregate paid-up capital of all banks in Kazakhstan;

the total paid-up capital of insurance companies with foreign participation, providing general and life insurance services shall not exceed 25 and 50 percent of the aggregate paid-up capital of general and life insurance companies respectively;

at least seventy percent of employees of a bank shall be residents of Kazakhstan; and at least one member of the Board of Directors of a bank with foreign participation shall be a resident of Kazakhstan.

The Program to develop the telecommunications sector provides for creation of a competitive framework for the telecommunications market. The exclusive license for a national operator was eliminated on January 1, 2006. The 49 percent foreign-capital restriction for joint ventures supplying architectural, urban-planning, construction and engineering services has been eliminated. Juridical entities of Kazakhstan with 100% foreign ownership will be allowed to provide those services.

Steps taken by the Government to liberalize the energy and transport sectors have also contributed to Kazakhstan’s negotiations on access to the services market.

Conclusion

The process of Kazakhstan’s accession to WTO represents a set of comprehensive reforms aimed at building sustainable market economy policies and institutions in the country. One of the major challenges still being addressed by the Government within the framework of the multilateral negotiations with WTO member-states is how to balance effective implementation of Kazakhstan’s key economic priorities, economic diversification and development of processing industries with the country’s commitments arising from WTO accession. We are carefully reviewing the policies and mechanisms applied by WTO member-states to facilitate development of “infant” industries, which supply new types of services and produce high value-added goods, in a WTO-consistent way.

Enhancement of customs administration and support to agricultural development are also among our key priorities. We fully recognize that we need to pursue further liberalization reforms in a systematic stage-by-stage manner in order to promote national economic interests. However, we also need to ensure that Kazakhstan’s economic and trade policy and regulatory changes are backed by strong institutional and human capacity.

Back to Top

[+] Foreign Investor FAQ

Due to political and economic stability in Kazakhstan, reach natural resources and high annual economic growth over the past several years, foreign investors continue to view Kazakhstan as a favourable place to do business.

One of the most important issues to foreign investors is the repatriation of their profits and the tax implications of their income. An analysis of the taxation of certain types of income in Kazakhstan is given below.

Civil legislation allows foreign investors to operate in Kazakhstan through either a local branch of a foreign company or a local subsidiary established as an independent legal entity under the laws of Kazakhstan. Naturally, a foreign investor should determine which type of investment structure is preferable.

Operating in Kazakhstan through a Branch Office

The branch’s profits are subject to corporate profit tax in Kazakhstan at a rate of 30 percent plus an additional tax on the net after-tax income of the branch (a so-called branch profit tax). Under Kazakh tax code, the branch profit tax rate is 15 percent. It is applied irrespectively whether profits are repatriated or not. This tax is similar to the tax withheld on dividends, but since tax on profits repatriated by Kazakh entities applies only when profits are actually distributed, a subsidiary can defer tax by not paying dividends.

A foreign company cannot charge fees to its Kazakh branch office branch office, because the head office and branch are part of the same entity. However, an affiliate company can charge fees to the branch office in Kazakhstan, so intra-group transactions are possible.

Operating in Kazakhstan through a Subsidiary

A foreign investor can choose to create a subsidiary in Kazakhstan in the form of a joint stock company (JSC) or a limited liability company (LLC).

Sometime potential foreign investors confuse Kazakh LLC with Russian “limited liability partnership” and they ask whether LLC is a “flow through” entity whose revenues and expenses flow through the entity and are attributed to the partners owning the entity, in accordance with the partnership taxation principles that are common in many countries. However, LLCs are not flow-through entities, therefore JSCs and LLCs are taxed similarly in Kazakhstan. Both are subject to corporate profit tax and their profit distributions are subject to income tax withheld at the source of payment at the rate of 15 percent. Profits distributed by a JSC are referred to as dividends, while profits distributed by LLCs are called income from equity investments (because LLCs do not issue shares), but the difference in nomenclature has no impact on the taxation of the profit distributions.

As a result of the adoption in 2004 of the law on JSCs, usually they work as public companies, while LLCs - as private companies, being most common organizational form for companies in Kazakhstan.

Any Kazakh-source income that a subsidiary company pays to a foreign parent company is subject to the same rates of income tax withholding, regardless of the type of entity paying the income, unless tax privileges granted by an international agreement. The following income tax rates apply to income paid by non-resident companies with no taxable permanent establishment in Kazakhstan:

Interest income 15%

Dividends and income from an equity investment in a Kazakh entity 15%

Premiums paid for insurance coverage 10%

Premiums paid for reinsurance 5%

Income from international transportation services 5%

Other income (royalty, fees for other types of services) 20%

Tax Treaty Benefits

Under Kazakh tax law, the deductibility of interest paid to a non-resident lender depends on the borrower’s capital structure. If the borrower’s debt-to-equity ratio exceeds a specified ceiling level, the interest paid to a non-resident lender is not fully tax-deductible in Kazakhstan. However, under the non-discrimination clause of many of Kazakhstan’s tax treaties, interest can be fully deductible if it is not paid to a related company. Thus, there can be a profit tax advantage from operating under a tax treaty.

Business profits from the active conduct of business in Kazakhstan, rather than passive investment in Kazakhstan, can be completely exempt from income tax in Kazakhstan if the non-resident business has no permanent establishment in Kazakhstan under the applicable tax treaty. In addition, foreign investors operating in Kazakhstan through a branch office can in many cases claim treaty relief and reduce the branch profit tax rate applicable to their branch’s profits. The branch profit tax under most of Kazakhstan’s tax treaties is 5 percent. Furthermore, Kazakhstan’s tax treaties typically provide for reduced income tax withholding rates for passive income such as dividends, interest, royalties. Most of Kazakhstan’s tax treaties provide for a reduced tax rate of 5 percent on dividends, and 10 percent on interest and royalties. Hence, it is often advisable to invest in Kazakhstan from a country that has a tax treaty in place with Kazakhstan.

The procedure for claiming treaty relief in Kazakhstan depends on the type of income for which treaty benefits are claimed. For passive income and income from services provided entirely outside of Kazakhstan, a non-resident of Kazakhstan which is a resident of a country that has a tax treaty with Kazakhstan can claim treaty benefits simply by providing to the payer a copy of a certificate from the non-resident’s home-country tax authorities confirming that the non-resident is a tax resident of that treaty-partner country. Likewise, a non-resident with a branch office in Kazakhstan can claim a treaty-reduced branch profit tax rate by obtaining from its home-country tax authorities a certificate confirming that the non-resident is a tax resident of that treaty-partner country.

The tax authorities of some countries are more cooperative about issuing such certificates confirming tax residency, so foreign investors may wish to take this into account when selecting a jurisdiction from which to invest into Kazakhstan. Investors from some countries may experience difficulty obtaining tax residency certificates if they operate in the form of a partnership in that country and if a partnership is not recognized in that country as a taxable entity that can be regarded as a tax resident. Thus, the type of entity organized in a particular country may also have an impact on the choice of jurisdiction from which to invest into Kazakhstan.

Summary

Foreign investors can earn many types of income from Kazakhstan. Some of the most common types are dividends from JSCs and income from equity investments in LLCs, royalties, interest income and management service fees.

From the perspective of diminishing the tax burden, it is generally advantageous for a foreign investor to invest in Kazakhstan from a country with a tax treaty in place with Kazakhstan. Usually, foreign investors represent multinational holdings with subsidiaries in multiple countries and have a variety of affiliates available for investment and activities in Kazakhstan. In that case, the foreign investor may be able to choose between various countries from which to invest into Kazakhstan.

Though these issues primarily relate to foreign investors, Kazakh resident customers often provide input to foreign suppliers and service providers regarding how to structure operations in Kazakhstan. By being flexible and knowledgeable about tax issues, Kazakh companies can help foreign suppliers and service providers reduce tax costs in Kazakhstan, and these tax savings can be partially passed on to the Kazakh customers in the form of lower product and service costs.

When making a decision regarding the jurisdiction from which to invest in Kazakhstan or the type of organizational form to use for activities in Kazakhstan, foreign investors are advised to seek professional advice.

Back to Top